The Threshold Question: Part 1

The very first question about any voyage like what we’re planning is: How will this be funded? We’re planning to leave our jobs (and associated income streams) for a year while cruising the Pacific, and although we expect our expenses will be greatly reduced, costs of groceries, moorage, visas, permits, internet, laundry, and countless other items will add up. What’s more, we’re not leaving indefinitely like some sailors do, so we’ll need to keep paying the mortgage and a few other expenses while we’re away. In fact, the money issue is the one thing that will make or break this voyage. If we don’t learn one more thing about sailing, navigation, homeschooling, meal planning, or anything else before going on this adventure, I won’t worry. But if there’s even the slightest chance of running out of money, the voyage will be over before it begins.

The very first question about any voyage like what we’re planning is: How will this be funded? We’re planning to leave our jobs (and associated income streams) for a year while cruising the Pacific, and although we expect our expenses will be greatly reduced, costs of groceries, moorage, visas, permits, internet, laundry, and countless other items will add up. What’s more, we’re not leaving indefinitely like some sailors do, so we’ll need to keep paying the mortgage and a few other expenses while we’re away. In fact, the money issue is the one thing that will make or break this voyage. If we don’t learn one more thing about sailing, navigation, homeschooling, meal planning, or anything else before going on this adventure, I won’t worry. But if there’s even the slightest chance of running out of money, the voyage will be over before it begins.

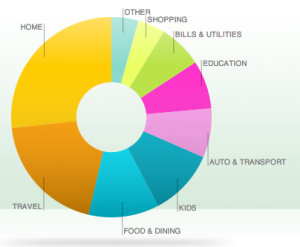

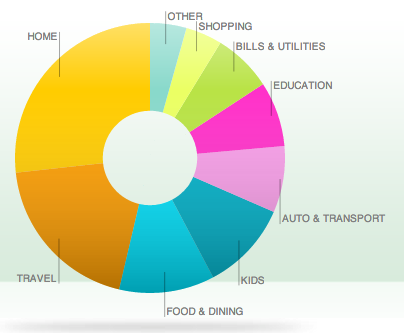

To that end, our first step in planning any portions of the trip was to have a meeting with our financial planner. No wait – even before that, we had to put together our current budget and our “boat year” budget. Here’s our first stab at the “boat year” budget:

| During Trip | |||

| Income | $4,400 | ||

| House Rental Income | $1,900 | ||

| Mama’s Freelance Legal Work | $2,500 | ||

| Dad’s Freelance Work | $0 | ||

| Expenses | $9,402 | ||

| Cars | $0 | ||

| Insurance | $0 | ||

| Dad’s Car’s License | $0 | ||

| Mom’s Car’s License | $0 | ||

| Car Payments | $0 | ||

| Gas | $0 | ||

| Service | $0 | ||

| Tolls | $0 | ||

| Utilities | $1,695 | ||

| Garbage | $0 | ||

| PSE | $0 | ||

| Internet | $1,500 | ||

| Mama’s Cell | $110 | ||

| Dad’s Cell | $50 | ||

| Sewer | $0 | ||

| Sewer Capacity Charge | $35 | ||

| Comcast | $0 | ||

| Water | $0 | ||

| Business Services | $25 | ||

| Mama Misc. | $10 | ||

| Internet Hosting | $10 | ||

| Business License | $5 | ||

| Entertainment | $20 | ||

| Life Insurance | $201 | ||

| Food & Dining | $1,250 | ||

| Groceries | $1,000 | ||

| Alcohol | $0 | ||

| Restaurants | $250 | ||

| Gifts & Donations | $100 | ||

| Gifts | $0 | ||

| Donations | $0 | ||

| Christmas Fund | $100 | ||

| Health | $1,100 | ||

| Dentist | $10 | ||

| Doctor | $50 | ||

| Eyecare | $10 | ||

| Pharmacy | $30 | ||

| Health Insurance | $1,000 | ||

| House | $3,691 | ||

| Property Management | $230 | ||

| Taxes | $0 | ||

| Insurance | $0 | ||

| Mortgage | $2,900 | ||

| HOA Dues | $11 | ||

| Furnishings | $0 | ||

| Improvement | $250 | ||

| Cleaners | $0 | ||

| Storage | $200 | ||

| Garden | $0 | ||

| Boat Fuel | $100 | ||

| Student Loans | $0 | ||

| Kids | $190 | ||

| Supplies | $50 | ||

| Cord Blood | $20 | ||

| Nanny | $0 | ||

| Babysitting | $100 | ||

| School | $0 | ||

| Activities | $20 | ||

| College Fund | $0 | ||

| Personal Care | $100 | ||

| Hair/Showers | $50 | ||

| Laundry | $50 | ||

| Shopping | $700 | ||

| Clothing | $500 | ||

| Mama’s Discretionary | $100 | ||

| Dad’s Discretionary | $100 | ||

| Taxes | $80 | ||

| State Taxes | $5 | ||

| Tax Prep Fees | $75 | ||

| Travel | $250 | ||

| All (moorage, visas, permits) | $250 | ||

| Monthly Problem | -$5,002 | ||

Personally, I think Dad’s estimate of my “freelance legal” potential (or desire) is optimistic.

On the expense side, there are a few bright notes. First, we’ll be selling the cars before we go, so no need to worry about ongoing car expenses. As for the student loans, we were delighted to discover that we’ll manage to get those paid off just before we shove off! So, no student loan payments while we’re away. The not-so-bright parts? Well, the rent we expect to receive won’t cover our mortgage, so keeping our house will be an ongoing loss. But, we bought the house right near the bottom of the market, so selling it and finding something new at about the same price when we return probably isn’t going to be an option.

We know these numbers are VERY rough, and will require extensive development and additional research. What do you think? Where are things on-target, and where are we way off?

We can go ahead and strike the Internet budget for now. Satellite Internet is just not going to make the budget… Marine SSB email combined with marina WiFi, where available, is probably the best we are going to be able to plan for.

Did you come up with a revised figure? You’ve already said you are ditching the internet cost. The biggest shock is that you will be renting your house out for much less than you are paying for it. I realise that you don’t want to sell your house for the sake of a year away but if that’s how the numbers look, how does anyone ever make money as a landlord? $500 a month on clothing seems excessive, especially as you won’t have many places to go clothes shopping. The health insurance looks staggering but I’m a Brit and not used to paying so much. I also thought about doing consulting work en route but I felt it was something I couldn’t commit to and certainly should not be something I had to do to cover a hole in the finances. I could be standing watches and dealing with bad weather or having to fix something that’s broken e.g. the SSB.

Our plans are to be away for much longer, maybe indefinitely. I stopped earning an income 6 months ago to concentrate on getting ready i.e. admin/accounts in order, selling the house, prepping the boat and also got rid of a lot of expenses associated with work e.g. flights, cars, clothes, accommodation, eating out, telecoms, business clothing. Since then I haven’t bought one iota of clothing and I’ve either given away my clothes to a charity or packed them in suitcases in storage. I can’t imagine that on passage that we are going to buy any more than a couple of replacement pairs of deck shoes and some teeshirts, and may replace our offshore suits after a couple of years. Using the Bumfuzzles as ‘worst case’ and other UK cruisers figure, I come to $1000 a month in cost. If we still had our house it would be more, but I’d expect the whole of the house cost to be offset by rental income.

Now that we’ve had some time to get organized, do research, etc some of this has definitely changed.. One large change is our expected rental income, we now believe the rental rate will be over $4000/mo, which puts it as a small income vs. a loss.

Health Insurance will likely end up being somewhere around $4000/year for International coverage (about $350/mo vs. $1000/mo).

Internet access can sort of be whatever we want it to be, there is no end to ways to spend money on Internet when you are abroad. We will have Satellite, but we will use it sparingly, so I suspect something like $100/mo in our budget for data use while on passages, etc.

And I agree on the clothes budget, right now we are looking for non-cotton clothes to bring on the boat, but I suspect our actual monthly spend on clothes will be very low.