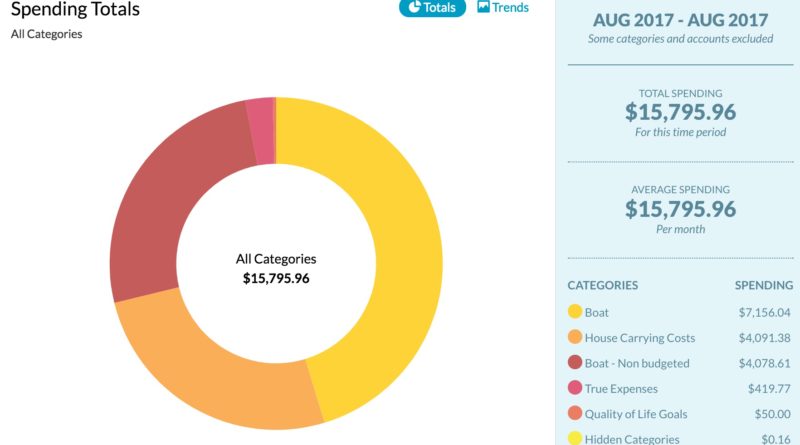

Costs of Cruising Alaska and British Columbia – August 2017

This month, our time was spent split right down the middle between Alaska and British Columbia, Canada. In both Alaska and BC (where we mostly provisioned north of Campbell River), grocery costs remained high, so I was disappointed we weren’t able to bring that budget line item down.

Our fuel costs went up a bit this month (up from $506.12 last month, to $607.26 for a few reasons. First, the wind refused to cooperate, and was almost always 10-20 knots right on our nose; so, we didn’t sail much. Second, we had to get south quickly to prepare for our early September departure to San Francisco, so we had to keep powering south even when the winds weren’t cooperating. We used our diesel heater most of the month, until the last week or so, when we finally found warm sunshine south of Campbell River.

Our expenses for guest moorage were up to $905.92 in August, from $213.59 in July. I thought we’d be able to keep this down, but we failed miserably. Waiting out the weather for two extra days in Ketchikan, and another extra weather day in Prince Rupert, were part of the problem. We also splurged on two nights at Gorge Harbour Marina, because it’s just so darn fun, and we really needed a break during our power south. I’m really, really hoping we can get our guest moorage fees down to near zero in September, and keep them low in October (even though we’ll be in San Diego for two weeks leading up to the Baja Ha Ha).

One major change in this month’s budget post: I’ve decided to include our home/car carrying costs. I omitted those last month because I figured they were not relevant and very specific to our family, but since other cruisers might also be looking at renting their homes, I thought it would be helpful to include.

| Item | Amount (USD) | Notes |

| House/Car Carrying Costs – Net Loss | $ 4,091.38 | We hope to see our first income from the house to offset costs (not turn a profit) in September; for now, our rental income goes to paying off the upgrades we did to rent it. |

| Bank Fees | $ 16.00 | Wells Fargo refunds these for us each month, so we expect to see this back on next month’s statement. |

| Cloud Data Storage/ Backups | $ 11.98 | |

| Cord Blood Storage | $ 250.00 | This is an annual cost to store the girls’ cord blood. Not sure how long we’ll continue it. |

| Computer/Phone Upgrades | $ 44.91 | We got my iPhone 6 on a payment plan. The jury is still out on whether we’d do it that way again. |

| Gifts | $ 96.88 | Both girls’ birthdays were in August. For each girl, we purchased one gift from Rich and me, and another from the sister. |

| Boat Payment | $ 1,088.94 | |

| Vessel Insurance | $ 379.31 | We pay $1502/year for our vessel insurance policy, covering Coastwise from Juneau, Alaska to Cabo, Mexico along the Pacific Coast. $225k Hull Value, $500k liability, $2k deductible. |

| Life Insurance | $ 200.40 | |

| Guest Moorage | $ 910.92 | Despite my best efforts to keep this in check, this number went up from last month |

| Fuel | $ 607.26 | We sailed less than 3 days our of 60 in SE Alaska, burning about 500 gallons of diesel between June 18 and Sept 1. We expect to sail more as we move south and this number should drop significantly. |

| Groceries | $ 1,057.14 | Includes alcohol. |

| Clothing | $ 0 | |

| Tools | $ 124.14 | $80 for 2 potable water hoses, because our stupid coil hoses were driving us crazy and not able to reach our tanks from the dock; and a drill-powered oil pump to change the main engine’s oil. |

| Galley Equipment | $ 200.00 | Hand mixer; FoodSaver bags; and some other random things that I honestly can’t remember what they were, so they probably weren’t important enough for us to have bought them. |

| Maintenance/ Improvement | $ 16.97 | Plumbing tape, oil drip pads |

| Electronics | $ 522.76 | New VHF, including new remote mic |

| Safety Equipment | $ 225.99 | 200ft of 5/8″ 3-strand Anchor rode; currently, we only have 230 feet of chain, so we purchased more rode to add-on. |

| Postage & Shipping | $ 6.03 | Canadian postage to mail some letters from the kids back to the US. |

| Restaurants | $ 1309.40 | Uh, yeah. We have a problem, and we need to do something about this. We just really love eating out. (Explanation from last month: We eat out at least one meal a day, sometimes two, when we’re in port; our bills always include alcohol; so, the frugal cruiser can easily reduce this expense.) |

| Coffee Shops | $ 63.11 | This includes a $50 Starbucks auto-reload. I keep meaning to cancel this. |

| Fishing Gear | $ 90.88 | Gaff and a few lures. |

| Kids’ Toys and Crafts | $ 15.17 | At least once a month, the girls need a new project to get them through long or rainy days. |

| Charts & Guides | $ 26.91 | Pilot book to start planning our California run. |

| Media | $ 30.77 | Monthly Netflix (not sure why we’re still paying for this when we have internet so rarely), and 2 movies on iTunes |

| Education | $ 10.98 | Subscription to Epic!, a reading app for the kids that has offline functionality. |

| Delorme InReach | $ 57.85 | Expedition Plan (unlimited text messages and 10 minute tracking) plus a few marine and premium weather forecast requests. Each premium or marine weather request costs $1. The marine forecasts are valuable as a second source of weather, but the premium are not necessary, so no need to request those for boaters. |

| Farkwar | $ 5.00 | We are cancelling this, as we really don’t use Farkwar. |

| Internet | $ 23.99 | Marina wifi fees. |

| Cell Phone Service | $ 110.42 | We actually pay about $185/month because Rich’s phone is on T-Mobile but run through our business which is not tracked by the budgeting system. $90/month for unlimited Verizon plus $20 for iPad, plus $75 for Unlimited T-Mobile. All of these plans included unlimited roaming in Canada and Mexico and the T-Mobile plan includes international roaming. |

| Satellite Phone | $ 69.00 | 6MB/month or 85Minutes/month, combo plan. Used sparingly and with a Redport Optimizer. |

| Software | $ 0 | |

| Major Repairs/ Upgrades | $ 4,078.61 | Iridium pilot pole and installation; engine lift parts and installation. |

| TOTAL | $ 15,743.10 |

As you can see, we’re quite a bit over what we’d originally anticipated of $10,000/month. So, we’re continuing to work to reel our costs in, but still enjoy all the adventure out there. We’re currently deciding whether a trip to Legoland is worth a few thousand.

In summary, we’re three months into our (hopefully) two-year cruise. Although we’re spending more than we anticipated, Rich’s severance, and some residual income I had coming in for a few months (which has now ended) has offset most of our costs. So, our $240,000 budget remains intact and fully available. That’s music to my budget-conscious ears, but we’ll have to get costs down going forward.

Wow! Just shows how the eating out costs can add up. Really useful information. Planning to go through Panama in 2019 so we will be a year behind. Will be interesting to see how your expenses stack up against our expectations. All the best as always. Steve and Lynne

I also track our cost of cruising and living aboard costs (you can find them here – http://thecynicalsailor.blogspot.com/p/blog-page_9.html). It really helps keep us focused on our budget and see where our money is going.

Love how you present yours graphically at the top. Makes it easy to visualize where the main areas of spending are.

Thanks for being brave enough to share budget specifics! Really helpful to others in the planning stage with budget questions. We plan to sail in the next 1 – 2 years with 3 little kids with much the same cruising plan as you. We’re in the boat shopping phase right now and selling allot of our stuff!

Your insurance seems on the high end to me at least compared to what I’m getting quotes from my current provider (Geico Marine). I’ve used them for a previous boat and maybe they suck when it comes to a claim – hope not to find out. Our quotes were including hull insurance and we are looking at older boats but a similar price range to what I’m guessing your boat is worth. I guess you can include whatever replacement cost you want – beyond what your loan is for and it depends on your risk comfort level.

What’s your iridium plan going to look like / cost and what’s included? Also, curious if you already have / use something like a Peplink setup. Offshore antenna with 4g hotspot router and local simcards? Is that your “Cell phone service” line item or are you using an American phone service with a Canadian plan?

For boat insurance, the costs will vary a lot depending on your boat and your experience, and where you’re cruising. If you plan to go offshore, Geico won’t insure you. We had to find insurers who focused on marine insurance when we started looking at going outside the Salish Sea (ie, north of Vancouver Island, and west of Neah Bay).

For Iridium, our plan is $69/mo and includes a set amount of pooled data/phone minutes. No, we don’t have a cell booster, partly because the technology changes between North America and the rest of the world so you need different booster antennae. So, that was why we didn’t go with it at first, but now we’re wishing we had.

Ah. Makes sense… “In US/Canadian waters only” is what my old policy reads and they did cover some other areas upon approval. Never noticed the fine print before: 12 miles from shore max in any coverage area! But, maybe that’s ok. Main concerns are impact near marinas, other vessels and towing insurance. After reading over other’s opinions on sailing uninsured, it seems it’s a very personal decision. Though I understand you may have no choice. I did receive quotes a year ago from a place in Seattle and Several East Coast companies when we were considering a mid 2000s Beneteau 423. Looking at them again, they are on par with your amounts! Maybe we’ll go with a coastal policy and offshore we’ll just be uninsured.

I hear Mexican Marinas require Mexican insurance? Is your policy going to have to change soon?

Full disclosure, our boat insurance policy has a $2K deductible, $225K hull value, and $500k liability. It also includes full electronics, tender, and personal effects coverage with tiny deductibles. It went up a bit when we extended our cruising area from Puget Sound/Southern BC Inside Passage to full Pacific Coast. We are covered from the northern tip of SE Alaska through Southern tip of Baja Mexico, Coastwise. Coastwise basically means that we can go out as far as makes sense offshore, but we can’t be crossing oceans.

For Mexico, we are covered for Cabo and Sea of Cortez, but we will need to look at new policies to go further south and west or east. My understanding is that in addition to your normal insurance you need as special Mexican Liability plan on top, which doesn’t replace your main policy. You also need a temporary import permit (TIP) when you enter as well. Once we get closer we will have more details on insurance and TIP requirements.

The other thing that may not have been clear.. The $379 vessel insurance is one of several payments for a 12 month policy but not a monthly payment. We pay about $1500 per year for insurance.

Would like to let you know how appreciated this kind of information is! Many of us get pigeon holed into thinking we know all the options. Really valuable to see a complete picture from someone vs. the little tidbits of info available on various forums. Thank again!