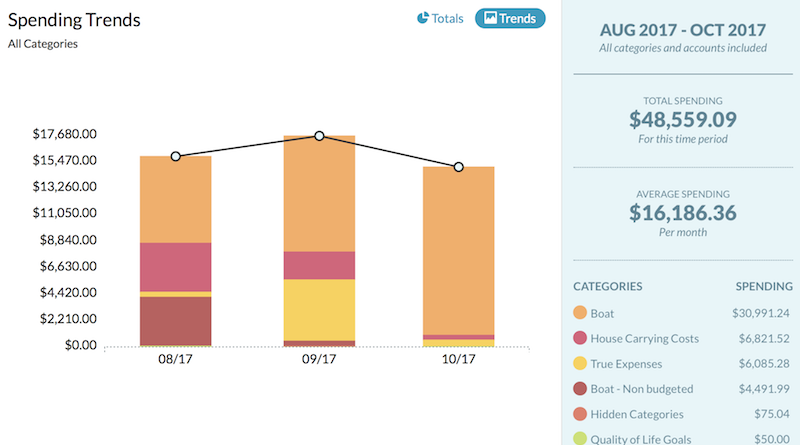

Costs of Cruising California – October 2017

Our spending continues to be higher than expected, and I continue to be grumpier than expected. Rich tries to placate me by explaining that this month, it’s high because of X, Y, and Z. But the problem is, the prior month he explained it was high because of U, V, and W. And the month before that, it was because of R, S, and T. Etcetera. Every month, we end up with high one-offs. I’d really like to see those go away.

There were two main one-offs this month that throw things off. The first was our visit to Legoland, coming in at $1,200. Despite my grumpiness about the budget, (and the Legoland Hotel’s stupid swimming pool rules,) it was well worth the trip and the money. The second one-off was a stock purchase of approximately $5K, and although we still technically have this money, we count it as an expenditure because we bought something with the money that is not liquid. And, it’s stocks, so for my conservative planning purposes, we have to assume it will go up in smoke any second now.

There was a third one-off that makes our overall budget look pretty good this month, and that’s the receipt of our solar incentive. In Washington, if you install solar in your house, you receive annual incentive payments for up to five years. We installed solar at our house, and received our incentive payment this month, making our house a nearly $3K net gain this month.

So, the bottom line – $8K in net spending – is improved over prior months, and I suppose I should be happy about that. But, I’m still looking forward to reigning in our spending. So, here’s the budget:

| Item | Amount | Notes |

| House/Car Carrying Costs – Net Gain | $ (3,850.97) | Rental income, less costs for storage with Clutter, HOA dues, property taxes, and insurance. Normally this is negative about $400, but this month we received our annual incentive payment for installing solar, so our carrying cost is actually carrying income. |

| Bank Fees | $ 3.00 | Wells Fargo refunds these for us each month, so this is the net of the new charges this month, plus whatever was refunded to us for the prior month. |

| Cloud Data Storage/Backups | $ 9.29 | iCloud storage. |

| Cord Blood Storage | $ 0.00 | Annual cost of $250, paid in August each year. |

| Computer/Phone Upgrades | $ 250.58 | My phone is $44.91/month; the remainder is a one-time cost for Rich to replace his phone under AppleCare, and to buy a new battery case. |

| Discount Memberships | $ 19.00 | West Marine rewards membership. |

| Gifts | $ 7.53 | We bought a can of something one of our boat friends needed. |

| Software | $ 22.01 | Adobe Creative Cloud software for Rich’s photography. |

| Boat Payment | $ 1,088.94 | Purchased in 2014 with a 20-year mortgage. |

| Vessel Insurance | $ 0.00 | We pay $1502/year, covering Coastwise from Juneau, Alaska to Cabo, Mexico. $500K liability, $2K deductible. Insurance costs vary depending on the boat, skippers’ experience, location, and coverages. |

| Mexico Liability Insurance | $ 328.28 | Mexican marinas require a special policy issued by a Mexican insurer. This is the premium we paid for one year. |

| Life Insurance | $ 200.40 | |

| Health Insurance | $ 645.00 | As soon as I get good enough internet, we’re switching to an international plan that’s closer to $200/month. The expensive plan was necessary while we were still in the US, to provide US coverage. The cheaper international plan provides only limited coverage in the US. |

| Prescriptions | $ 255.79 | Before we left San Diego, I procured a six-month supply of my prescription. |

| Boat Licensing | $ 31.00 | Annual USCG vessel documentation fee for Mobert. |

| Guest Moorage | $ 501.74 | |

| Fuel | $ 290.69 | WAY down from Alaska! |

| Groceries | $ 1,196.33 | |

| Medical Supplies | $ 0.00 | |

| Clothing | $ 0.00 | |

| Laundry | $ 15.00 | All in quarters! |

| Haircuts | $ 0.00 | |

| Tools | $ 0.00 | |

| Galley Equipment | $ 39.90 | We broke one of our bowls, and the pattern is discontinued, so we decided to replace it right away. But, we could only replace it with a set of six, so now we have 10 (because we broke a second one right after the new ones arrived, of course). |

| Rigging/Deck | $ 25.00 | Rich bought a Jeanneau Owners’ burgee. |

| Cabin Comfort | $ 0.00 | |

| Maintenance/Improvement | $ 371.81 | Screws for swim ladder LEDs; hose adapter to fix the cockpit shower (the head was coming off the hose); bow thruster joystick for the starboard side only (to see if replacing just one joystick would fix it – it didn’t, the other one is still broken, but at least we can now use it with the one); switches for miscellaneous electrical projects; gloves; fuel towels; and Racor drain valves. |

| Electronics | $ 108.73 | Weatherfax software; audio cable for SSB weatherfax. |

| Safety Equipment | $ 0.00 | |

| Airfare | $ 0.00 | |

| Postage & Shipping | $ 68.85 | Mailbox service; cost to mail one small package. |

| Land Transportation | $ 110.75 | |

| Restaurants | $ 1,357.21 | |

| Coffee Shops | $ 274.43 | |

| Fishing Supplies | $ 74.33 | New lures, since obviously the ones we have aren’t working. |

| Activities & Excursions | $ 1,261.64 | Legoland costs. |

| Kids’ Toys & Crafts | $ 10.99 | Morgan earned a Kidz Bop album by powering through her schoolwork several days in a row. |

| Charts & Guides | $ 50.00 | Purchased World Cruising Routes, Pacific Mexico, and Sea of Cortez books used from another cruiser. The first, World Cruising Routes, is great for large-scale planning; i.e., where can I be in the world when? When and where do I go/avoid to steer clear of hurricanes? The second two books are the best cruising guides we’ve ever purchased, and they’re a necessity for anyone cruising Mexico! |

| Media & Entertainment | $ 33.37 | Monthly Nexflix subscription, and a movie. |

| Educational Materials | $ 33.44 | Epic! subscription, and fish identification cards. |

| Delorme InReach | $ 60.38 | LOVE the unlimited text messaging on this! |

| Farkwar | $ 5.00 | |

| Internet | $ 35.94 | Wifi in Avalon for 6 days. |

| Cell Phone Service | $ 185.45 | |

| Satellite Phone | $ 69.00 | |

| TOTAL EXPENDITURES | $ 5,189.83 | |

| Side Businesses | $ 2,520.44 | |

| Investments | $ (5,403.21) | Net cost of purchasing more stock. So, we didn’t really lose this money, but YNAB counts it as an expense. |

| TOTAL INCOME | $ (2,882.77) | |

| NET | $ (8,072.60) |

Unfortunately, I’m writing this post too late to view the end-of-month numbers for October (and without enough internet), so I can’t give the savings summary of how much of our savings we have left, and how much time we have left cruising before we break the bank. So, check back soon for our November budget post to see!